haicaron912758

About haicaron912758

The Ultimate Information to Gold IRA Kits: Secure Your Retirement With Valuable Metals

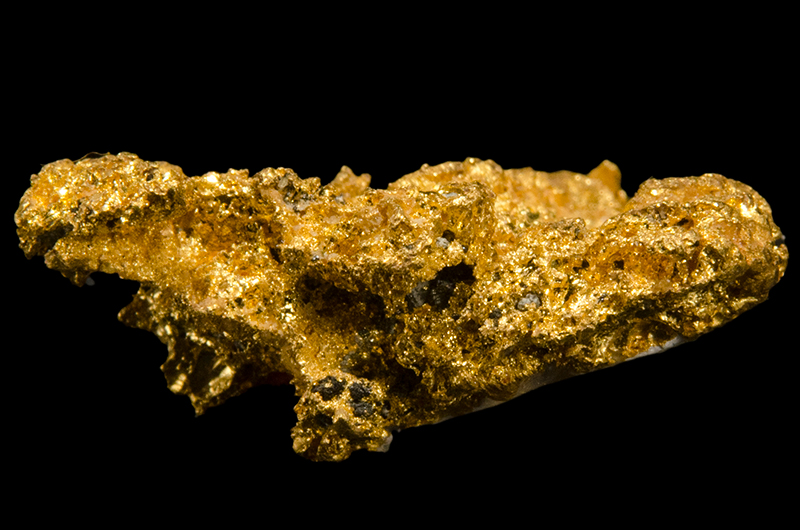

In recent years, the popularity of gold and different valuable metals as investment options has surged, especially among people seeking to secure their retirement savings. A Gold Individual Retirement Account (IRA) offers a unique opportunity to diversify your retirement portfolio by together with bodily gold and different treasured metals. This text will discover the concept of Gold IRA kits, their advantages, how they work, and what you want to consider when setting one up.

What’s a Gold IRA?

A Gold IRA is a sort of self-directed Individual Retirement Account that enables traders to carry physical gold, silver, platinum, and palladium as part of their retirement savings. Unlike conventional IRAs, which usually hold paper property like stocks and bonds, a Gold IRA provides a hedge towards inflation and market volatility by investing in tangible assets.

Why Invest in Gold?

- Inflation Hedge: top gold ira companies in usa (Irasgold.com) has traditionally maintained its worth throughout periods of inflation. When forex values decline, gold typically rises, making it a wonderful safeguard in your buying power.

- Market Volatility: The inventory market may be unpredictable, and economic downturns can considerably influence your retirement savings. Gold tends to perform effectively during these occasions, offering a stabilizing impact in your portfolio.

- Diversification: Including gold in your retirement portfolio can cut back general risk. Diversification is a key precept of investing, and precious metals can provide an alternate asset class that behaves in another way from stocks and bonds.

- Tangible Asset: In contrast to stocks or bonds, gold is a bodily asset that you can hold in your hand. This tangibility can present peace of thoughts for traders who choose to have one thing concrete in their funding strategy.

What is a Gold IRA Kit?

A Gold IRA kit is a comprehensive package that usually consists of all the mandatory info and instruments to help traders set up and manage their Gold IRA. These kits are designed to simplify the process and often embody:

- Academic Supplies: Guides and brochures that explain the advantages of investing in gold, the several types of gold investments out there, and the process of establishing a Gold IRA.

- Account Setup Directions: Step-by-step instructions on the right way to open a Gold IRA account, together with data on selecting a custodian, funding the account, and choosing the right treasured metals.

- Investment Choices: An inventory of accredited gold and other precious metals that can be included within the IRA, along with specs for purity and form (e.g., coins, bars).

- Storage Options: Information on safe storage choices in your bodily gold, as it have to be stored in an IRS-accepted depository to adjust to rules.

How one can Arrange a Gold IRA

Organising a Gold IRA includes a number of key steps:

- Choose a Custodian: The first step is to pick out a reputable custodian who focuses on Gold IRAs. The custodian will manage your account and ensure compliance with IRS regulations.

- Open an Account: As soon as you’ve chosen a custodian, you’ll need to complete the mandatory paperwork to open your Gold IRA account. This will contain offering private data and funding details.

- Fund Your Account: You may fund your Gold IRA via contributions, rollovers from current retirement accounts, or transfers from different IRAs. Be certain to understand the contribution limits and tax implications.

- Choose Your Valuable Metals: Together with your account funded, you may select the precise gold and other valuable metals you want to invest in. It’s important to pick out IRS-accepted products to make sure compliance.

- Storage: After purchasing the metals, they must be saved in an IRS-permitted depository. Your custodian can assist with this process, guaranteeing your property are safe and compliant with laws.

- Monitor Your Investment: Frequently review your Gold IRA to track performance and make adjustments as wanted. Keep informed about market developments and modifications within the treasured metals market.

Key Issues

- Fees: Gold IRAs can involve numerous fees, together with setup fees, annual maintenance fees, and storage charges. It’s essential to know these costs upfront and issue them into your investment strategy.

- Tax Implications: Whereas Gold IRAs supply tax advantages, resembling tax-deferred development, it’s important to grasp the tax implications if you withdraw funds or promote your gold. Consult a tax skilled for guidance.

- Market Threat: Whereas gold is usually seen as a secure funding, it isn’t without risk. The worth of gold can fluctuate primarily based on market situations, geopolitical occasions, and modifications in demand. Diversifying your portfolio may also help mitigate this threat.

- Rules: Be sure that your Gold IRA complies with IRS rules. This contains utilizing authorized custodians and depositories and investing in eligible metals.

Conclusion

A Gold IRA kit may be a useful useful resource for individuals seeking to diversify their retirement savings with precious metals. By understanding the benefits of gold, the process of setting up a Gold IRA, and the issues involved, you can make knowledgeable decisions that align along with your monetary targets. As with any funding, it’s important to do your analysis, consult with monetary advisors, and keep knowledgeable about market developments to maximize the potential of your Gold IRA. Investing in gold can provide peace of thoughts and safety to your retirement, making it a worthwhile consideration on your funding technique.

No listing found.