odelln81616036

About odelln81616036

Understanding Gold IRA Investing: A Comprehensive Guide

irasgold – https://irasgold.com;

Investing in a Gold Particular person Retirement Account (IRA) has gained reputation amongst buyers seeking to diversify their retirement portfolios and hedge towards economic uncertainty. This text aims to provide a thorough understanding of Gold IRA investing, together with its benefits, dangers, and the process of setting one up.

What’s a Gold IRA?

A Gold IRA is a sort of self-directed Particular person Retirement Account that enables buyers to carry physical gold and other valuable metals as part of their retirement financial savings. Unlike conventional IRAs that usually hold stocks, bonds, and mutual funds, a Gold IRA provides the chance to spend money on tangible belongings. This can embody gold coins, gold bars, silver, platinum, and palladium, all of which should meet specific purity standards set by the interior Revenue Service (IRS).

Advantages of Gold IRA Investing

- Hedging In opposition to Inflation: Gold has historically been seen as a secure haven throughout financial downturns. When inflation rises or the value of currency declines, gold often retains its value or even appreciates, making it an effective hedge.

- Diversification: Including gold in your investment portfolio may also help diversify your property. This diversification can scale back general threat since gold usually behaves in a different way than stocks and bonds.

- Tangible Asset: Unlike stocks or mutual funds, gold is a bodily asset which you can hold in your hand. This tangibility can provide a way of security for investors who are wary of the volatility of paper assets.

- Tax Advantages: Just like other IRAs, Gold IRAs offer tax-deferred development. This implies that you just won’t pay taxes on the positive aspects from your investments till you withdraw funds during retirement.

- Safety Against Financial Instability: Gold has an extended historical past of maintaining its value throughout instances of financial and political turmoil. This stability can be appealing to buyers on the lookout for a dependable retailer of value.

Dangers of Gold IRA Investing

- Market Volatility: While gold is mostly thought of a secure-haven asset, it isn’t immune to market fluctuations. Costs might be unstable within the short time period, which may not suit each investor’s danger tolerance.

- Storage and Insurance coverage Prices: Bodily gold should be stored in a secure location, often requiring a safe deposit box or a specialised storage facility. These prices can add up over time and should be factored into your funding strategy.

- Restricted Development Potential: In contrast to stocks, which can present dividends and capital appreciation, gold does not generate income. Its worth is primarily based on market demand and provide, which will not be as predictable as other investments.

- Regulatory Restrictions: Gold IRAs must comply with IRS regulations, including the kinds of metals that may be held and where they are often saved. Investors must remember of these rules to avoid penalties.

The way to Set up a Gold IRA

Organising a Gold IRA entails several steps:

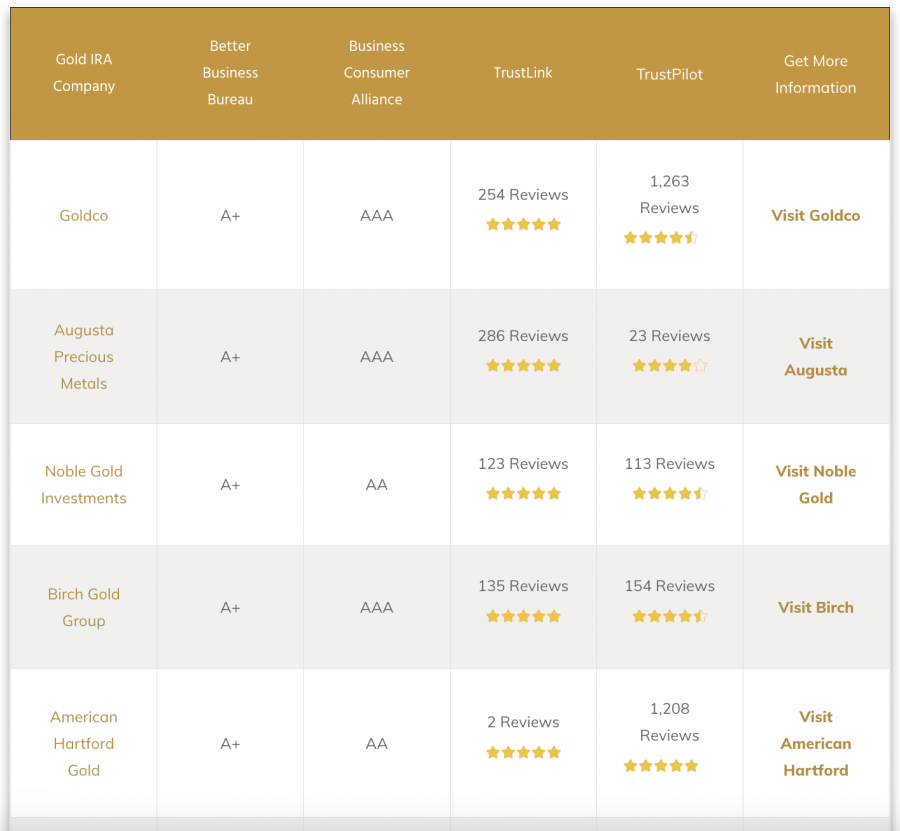

- Choose a Custodian: Step one in establishing a Gold IRA is selecting a certified custodian. This is a monetary institution that will handle your account and ensure compliance with IRS laws. It’s essential to choose a custodian skilled in handling precious metals.

- Open Your Account: As soon as you’ve selected a custodian, you possibly can open your Gold IRA account. This process sometimes includes filling out paperwork and offering identification.

- Fund Your Account: You’ll be able to fund your Gold IRA by means of numerous methods, together with rolling over funds from an existing retirement account, making a direct contribution, or transferring belongings. Ensure you understand the tax implications of every funding method.

- Choose Your Precious Metals: After funding your account, you can select which gold and other treasured metals to spend money on. Be sure that to select metals that meet the IRS purity standards (e.g., gold have to be not less than 99.5% pure).

- Purchase and Store Your Metals: Your custodian will facilitate the acquisition of the chosen metals and arrange for their storage in a safe, IRS-authorised facility. You can not take physical possession of the metals whereas they are in your IRA.

- Monitor Your Funding: Like all investment, it’s crucial to watch the efficiency of your Gold IRA often. Stay informed about market trends and economic conditions that may impression gold costs.

Conclusion

Gold IRA investing generally is a invaluable addition to a diversified retirement portfolio, offering benefits resembling inflation safety and tangible asset safety. Nevertheless, it is essential to contemplate the associated dangers, together with market volatility and storage prices. By understanding the process of setting up a Gold IRA and the factors concerned in investing in valuable metals, you can also make knowledgeable decisions that align with your financial goals. As with any funding, consulting with a financial advisor is recommended to tailor your technique to your individual wants and circumstances.

No listing found.